U.S. Tariffs UPDATE – 01-JUN-2018

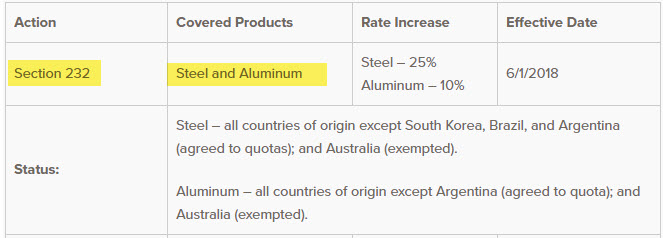

USA Trade Actions (Simplified Table)

Note: Be careful not to get information from marketing firms, self promoting press releases, or public relations firms which are likely to be exaggerated or wholly inaccurate. Only trust information from the US Department of Commerce (.gov domain name websites).

SECTION 232 - Steel & Aluminum

————————————————————–

Steel and Aluminum Tariff Exemptions Modified

For Steel:

On April 30th, the President of the USA issued a proclamation on steel that extended country exemptions until June 1st for Canada, Mexico, Australia, Argentina, South Korea, Brazil and member countries of the European Union.

South Korean shipments of steel will now be processed as Quota entries. Starting June 1st, the exemption will include only Argentina, Australia, and South Korea.

For Aluminum:

On April 30th, the President of the USA issued a proclamation on aluminum that extended the country exemptions until June 1st for Canada, Mexico, Argentina, Australia, Brazil and member countries of the European Union.

The extension does not include South Korea. Starting June 1st, the exemption will include only Argentina, Australia, and Brazil.

In addition, on May 1st, U.S Customs issued CSMS message #18-000317, confirming that goods subject to the Section 232 additional Steel and Aluminum duties may not receive Generalized System of Preferences (GSP) or African Growth and Opportunity Act (AGOA) special program trade preferences retroactive to March 23rd.

However, U.S. Customs did indicate that other special programs would continue receiving preferential duty rate and any MPF exemption that may apply.

Cargo that falls under the Section 232 Steel and Aluminum duties that is entered into Foreign Trade Zones must do so under “privileged foreign status” and will be subject upon entry for consumption to any ad valorem rates related to the applicable HTSUS subheading except those eligible for admission under

“domestic status”.

Drawback will not be available with respect to the Section 232 duties imposed on any aluminum or steel article.

U.S. Tariffs on Steel and Aluminum will take effect on March 23, 2018.

————————————————————–

Q1 – To Which Automotive Related Products is Exposed by the Recent USA Trade Tariffs?

At the current time, the USA is adding an import duty to the import of raw material Steel (25%) and Aluminum (10%).

U.S. President Donald Trump has temporarily excluded six countries, including Canada and Mexico, and European Union states from higher U.S. import duties on steel and aluminum meant to come into effect on Friday, MAR 23rd.

on Friday, MAR 23rd.

————————————————————–

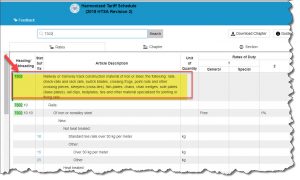

Q2 – Where Can Go to Look Up the Most Up To Date Tariff Codes?

There is only 1 official location in which to look up the official USA tariff codes (HTS codes).

The Department of Commerce in Washington DC, where SOLO’s president used to work, is the only place that creates and publishes this (continuously changing) official list.

Don’t be confused  by “for profit” websites that claim to have these official numbers as it causes more confusion than anything else.

by “for profit” websites that claim to have these official numbers as it causes more confusion than anything else.

Find HTS Codes:

https://hts.usitc.gov/

————————————————————–

Q3 – What Does SOLO Recommend to Do?

Each circumstance is unique and a brief conversation is advised. However, there are two areas in which to direct focus, ….

Foreign Trade Zone (USA) | IMMEX (Mexico)

Please call the SOLO team to learn more. SOLO’s company president has worked inside the US Department of Commerce (Washington DC) and can help answer your emergency questions with first-hand knowledge about tariffs and how the federal government works.

The tariffs will take effect on March 23, 2018. However, Canada and Mexico are exempt from tariffs, depending upon progress in the renegotiation of the North America Free Trade Agreement (NAFTA).

Proclamations may be found here: steel, aluminum

Steel Articles: Subject to additional 25% duty:

The proclamation defines “steel articles” using HTS schedule subheadings.

• 7206.10 through 7216.50

• 7216.99 through 7301.10

• 7302.10

• 7302.40 through 7302.90

• 7304.10 through 7306.90

The additional duties are set forth in a revised Subchapter III Chapter 99 of the HTS.

Aluminum Articles: Subject to additional 10% duty:

The proclamation defines “aluminum articles” using HTS schedule subheadings.

• unwrought aluminum – HTS 7601

• aluminum bars, rods, and profiles – HTS 7604

• aluminum wire – HTS 7605

• aluminum plate, sheet, strip, and foil – HTS 7606 and 7607

• aluminum tubes and pipes and tube and pipe fitting HTS – 7608 and 7609

• aluminum castings and forgings HTS 7616.99.5160 and 7616.99.5170

The additional duties are set forth in a revised Subchapter III to Chapter 99 of the HTS.

Both proclamations allow for directly affected parties in the United States to petition the Commerce Department for relief from the duties on the basis that certain steel or aluminum articles are not produced in the United States in sufficient and reasonably available amounts or of a satisfactory quality.

In addition, the Commerce Department is authorized to provide relief to specific countries based upon national security considerations. The procedures for requesting relief will be published in the next ten days.