U.S. Tariffs UPDATE – 09-MAY-2019

Stay Current with All Announcements … https://ustr.gov

Check Your HTS for Section 301 Duties …

https://ustr.gov/issue-areas/enforcement/section-301-investigations/search

MAY 2019 – $200 Billion Tariffs Increased from 10% to 25%

________________________________________________________________________

“SUMMARY: In a notice published on May 9, 2019 (May 9 Notice), the U.S. Trade Representative (Trade Representative) increased the rate of additional duty from 10 percent to 25 percent for the products of China covered by the September 2018 action that are (i) entered for consumption, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on May 10, 2019, and (ii) exported to the United States on or after May 10, 2019. This notice provides that products of China that are covered by the September 2018 action and that were exported to the United States prior to May 10, 2019, are not subject to the additional duty of 25 percent, as long as such products are entered into the United States prior to June 1, 2019. Such products remain subject to the additional duty of 10 percent for this interim period.”View Full Transcript (here)

U.S. Tariffs UPDATE – 22-SEP-2018

USA Trade Actions (Simplified Table)

Note: Be careful not to get information from marketing firms, self promoting press releases, or public relations firms which are likely to be exaggerated or wholly inaccurate. Only trust information from the US Department of Commerce (.gov domain name websites).

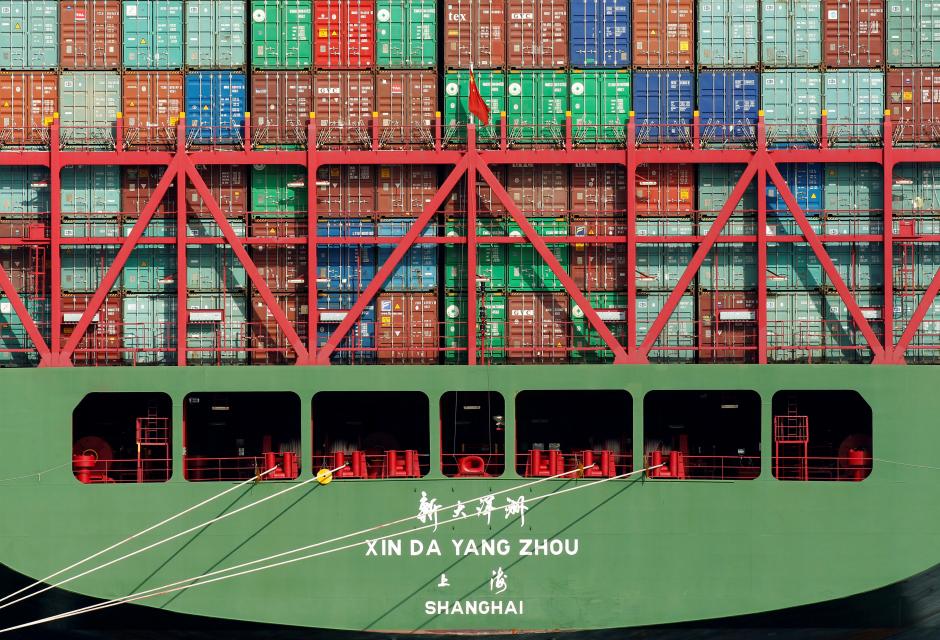

SEP 2018 – $200 Billion Tariffs

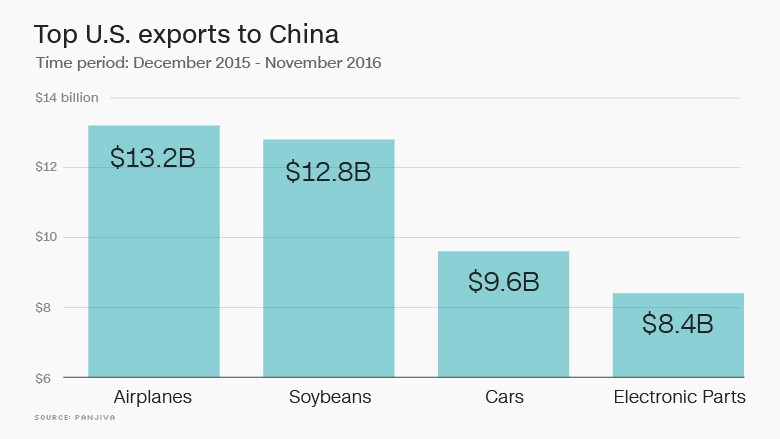

On September 17, 2018, the US Trade Representative (USTR) released the following statement on approximately 5745 lines of the third list of section 301 tariffs: “As part of the United States’ continuing response to China’s theft of American intellectual property and forced transfer of American technology, the Office of the United States Trade Representative (USTR) today released a list of approximately $200 billion worth of Chinese imports that will be subject to additional tariffs.

In accordance with the direction of President Trump, the additional tariffs will be effective starting September 24, 2018, and initially will be in the amount of 10 percent. Starting January 1, 2019, the level of the additional tariffs will increase to 25 percent.”

297 tariff lines on the original list were fully or partially removed. The duty on this list will rise to 25% at the beginning of next year if China has not made progress in the dispute with the U.S.

A formal notice of the tariff action will be published shortly in the Federal Register.

LIST #3 Products (24-SEP-2018) – CLICK HERE:

… Below is a history of the previous rounds of Tariffs related to products imported from China.

SECTION 301- (JUN-SEP) - Various Parts As Determined by President Trump

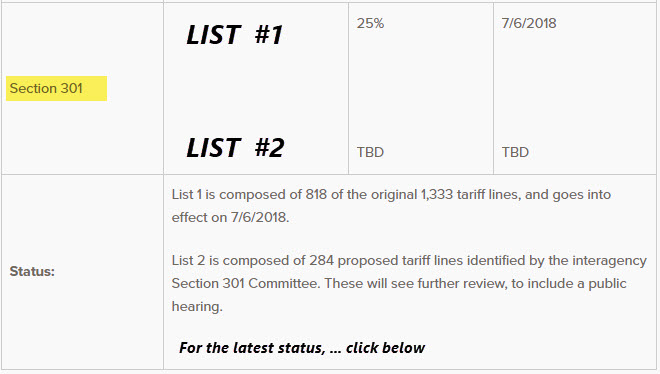

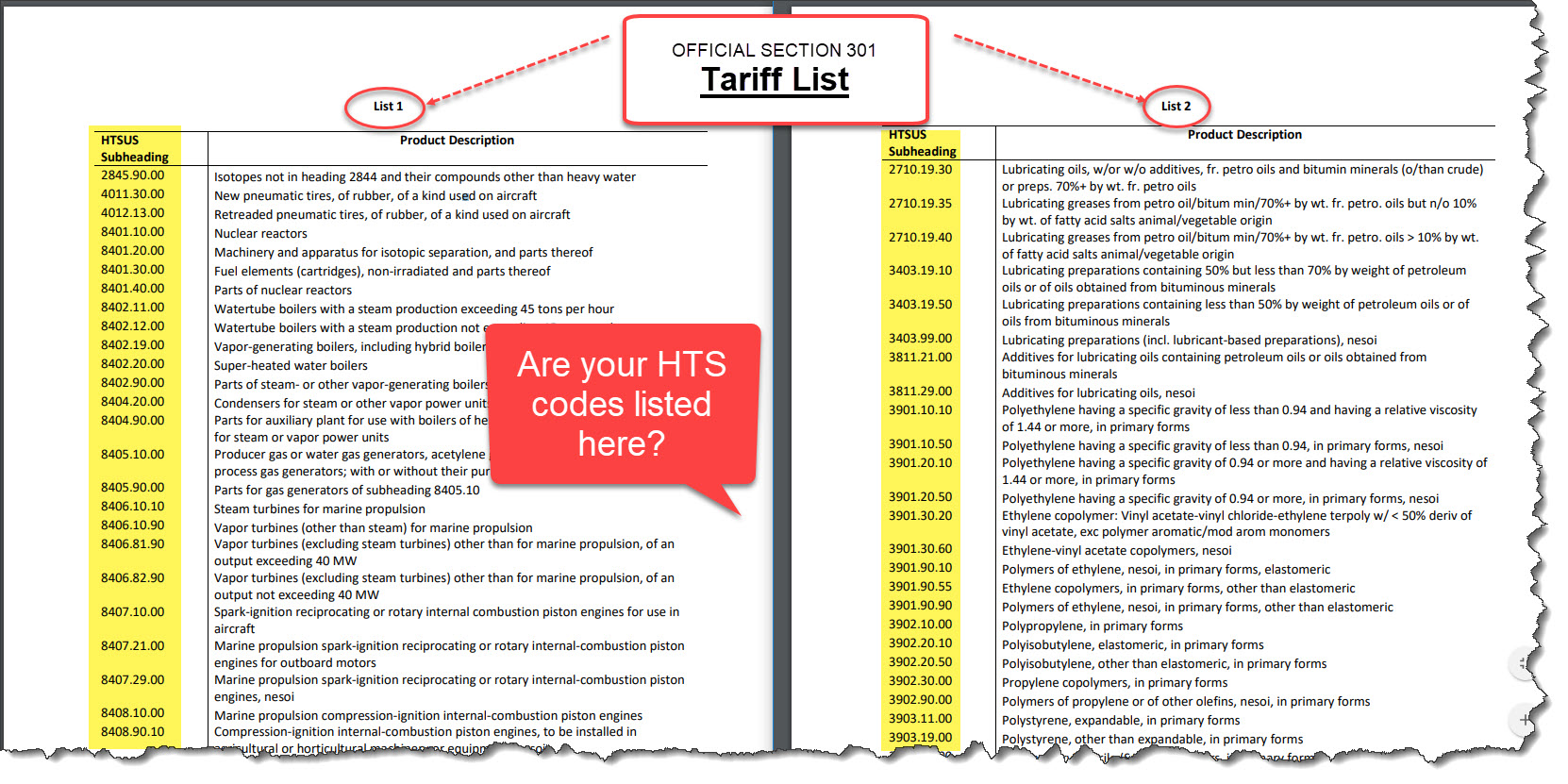

This schedule (301) is composed of 3 (THREE) lists:

1. The first list of 818 articles will receive 25% additional duty and comes from the original list of 1,333 published on April 6, 2018.

2. The second list of 284 articles that benefit from the “Made in China 2025” policy will undergo further review with public hearings and comments and are expected to result in a final list on which the USTR will act. To that end, the USTR will issue a notice in the Federal Register regarding the details for this process within the next few weeks.

LIST #1 Products – CLICK HERE:

LIST #2 Products – CLICK HERE:

For the complete official USTR Issues Tariffs on Chinese Products statement CLICK HERE:

————————————————————–

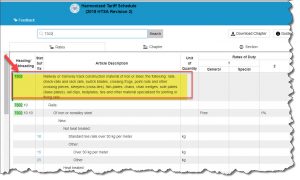

Q1 – Where Can Go to Look Up the Most Up To Date Tariff Codes?

There is only 1 official location in which to look up the official USA tariff codes (HTS codes).

The Department of Commerce in Washington DC, where SOLO’s president used to work, is the only place that creates and publishes this (continuously changing) official list.

Don’t be confused  by “for profit” websites that claim to have these official numbers as it causes more confusion than anything else.

by “for profit” websites that claim to have these official numbers as it causes more confusion than anything else.

Find HTS Codes:

https://hts.usitc.gov/

————————————————————–

Q2 – What Does SOLO Recommend to Do?

Each circumstance is unique and a brief conversation is advised. However, there are two areas in which to direct focus, ….

Foreign Trade Zone (USA) | IMMEX (Mexico)

Please call the SOLO team to learn more. SOLO’s company president has worked inside the US Department of Commerce (Washington DC) and can help answer your emergency questions with first-hand knowledge about tariffs and how the federal government works.